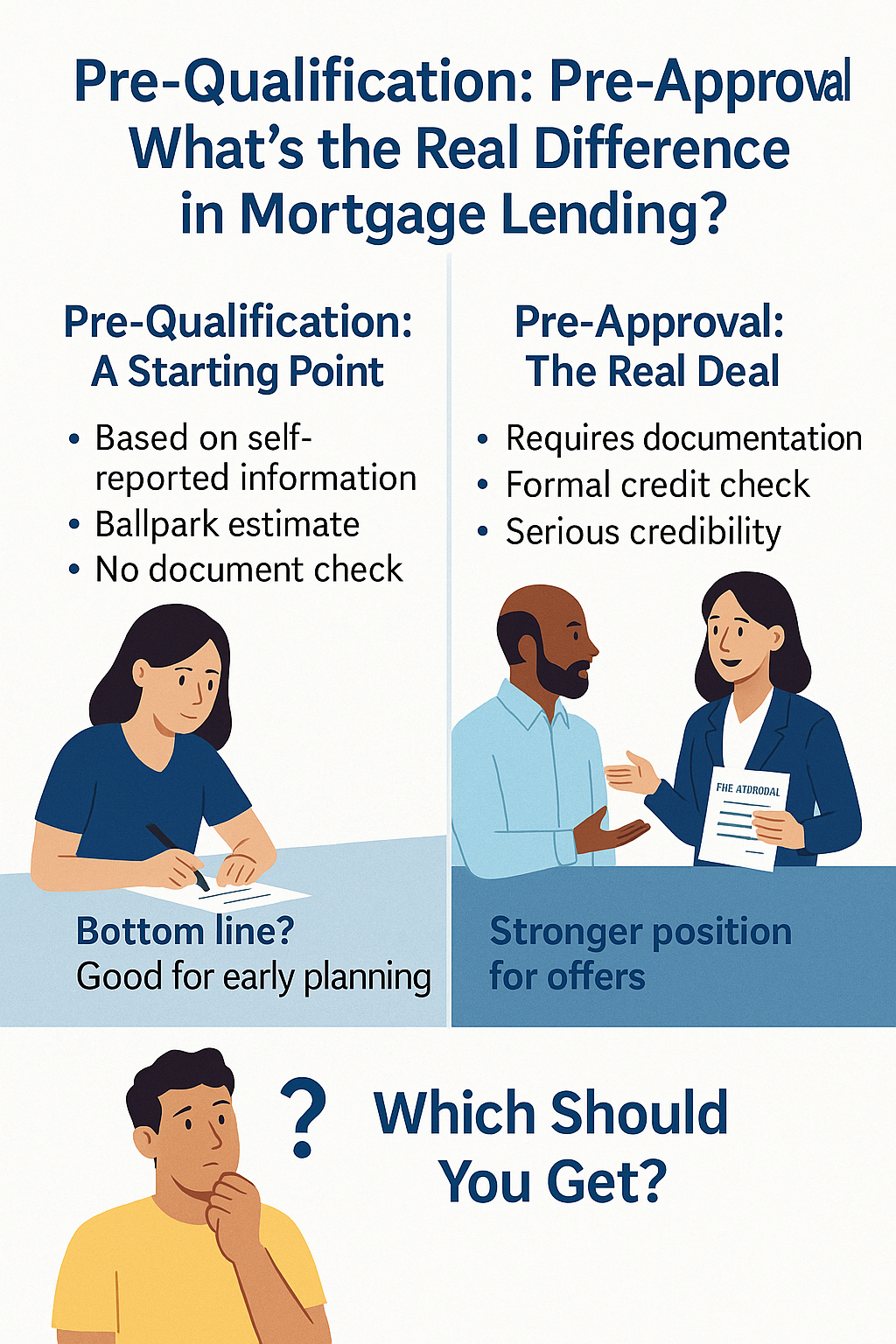

Pre-Qualified vs. Pre-Approved: What's the Real Difference in Mortgage Lending?

If you’re beginning the journey to buy a home, you’ve probably heard the terms “pre-qualified” and “pre-approved” tossed around. While they sound similar, they carry very different weight—especially when you're competing for a home in a hot market.

Let’s break down the difference:

Pre-Qualification: A Starting Point

Think of pre-qualification as a friendly financial chat. You give a lender some basic info—like your income, debts, and assets—and in return, they give you a ballpark estimate of what you might be able to borrow.

Here’s the catch:

It’s often based on self-reported information.

There may be no formal credit check.

It doesn’t involve document verification.

Bottom line? A pre-qualification letter is helpful for early planning, but it doesn’t carry much weight when you’re ready to make an offer. It tells sellers you’re interested—not necessarily that you’re ready.

Pre-Approval: The Real Deal

Pre-approval, on the other hand, is the lender’s way of saying, “We’ve looked under the hood, and we like what we see.”

To get pre-approved, you’ll need to:

Submit detailed documentation (pay stubs, tax returns, bank statements, etc.)

Agree to a credit check

Let the lender verify your income, assets, and debts

In return, you get a more accurate loan estimate—and serious credibility.

Why it matters:

A pre-approval letter tells sellers and agents that you’ve already cleared some of the biggest financial hurdles and are well-positioned to close. In a competitive market, it can be the difference between winning or losing the deal.

Which Should You Get?

If you’re just dipping your toe in the water, a pre-qualification is a fine place to start. But if you’re serious about buying and ready to make offers, get pre-approved. It shows you're financially prepared—and that you mean business.

Whether you're a first-time buyer or a seasoned investor, understanding the distinction between pre-qualification and pre-approval will help you make smarter, faster, and more confident real estate decisions.

Would you like a shorter version for a blog post or social media?